Tongwei Co., Ltd is currently the top producer of polysilicon.

Global Polysilicon Market

Overview of the Polysilicon Market

The polysilicon market is a dynamic entity and plays a pivotal role in the high-tech sector. The soaring demand for renewable energy, primarily solar energy, has propelled the growth of the polysilicon market to new heights.

The market is characterized by its vast diversity, with numerous players vying for significant shares. This competitive landscape is marked by innovations, advancements in technology, and strategic alliances among companies.

Major Players in the Polysilicon Market

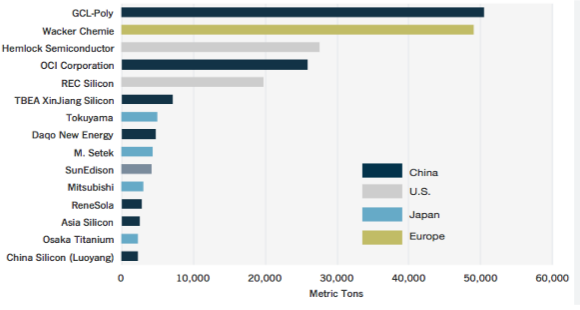

Among these, Wacker Chemie AG, OCI Company Ltd., and GCL-Poly Energy Holdings Limited are considered as the market dominators. These companies have been pioneering innovations and maintaining robust production lines to ensure a steady supply of high-quality polysilicon.

- Wacker Chemie AG: This German giant is renowned for its extensive production capacity and high-quality polysilicon. With an annual production capacity of over 80,000 MT, Wacker Chemie AG has been a leading contributor to the global supply of polysilicon. The company’s extensive expertise in producing high-purity polysilicon has set industry standards.

- OCI Company Ltd.: Hailing from South Korea, OCI Company Ltd. has established itself as a major player with a substantial production capacity, standing at around 70,000 MT per annum. The company’s commitment to quality and innovation has enabled it to secure a significant market share.

- GCL-Poly Energy Holdings Limited: Based in China, GCL-Poly has been instrumental in meeting the global polysilicon demand, with a production capacity exceeding 65,000 MT per annum. The company specializes in the production of high-quality polysilicon, ensuring optimal performance and durability.

Market Share Analysis

A meticulous market share analysis reveals the extent to which major companies dominate the polysilicon sector. Wacker Chemie AG, with its expansive production capabilities and technological innovations, holds approximately 25% of the global market share.

The market share analysis is pivotal in understanding the competitive dynamics and gauging the influence of major players in shaping the polysilicon industry. It provides insights into market trends, prevailing prices, and production capacities, allowing stakeholders to make informed decisions.

In terms of price, the cost per kilogram of polysilicon has been witnessing fluctuations, with prices ranging from $10 to $16 per kg, depending on the purity and quality.

Top Producers of Polysilicon

Company Profiles

In the global polysilicon market, several organizations have marked their presence prominently, making significant contributions to the sector. Here’s a detailed look into the profiles of the top polysilicon producers.

- Wacker Chemie AG Wacker Chemie AG, a company headquartered in Munich, Germany, stands as a colossal entity in the polysilicon market. It is renowned for its extensive production capabilities, which exceed 80,000 MT per annum, and its commitment to delivering high-purity polysilicon. The firm sets industry benchmarks by maintaining stringent quality standards and pioneering innovations. Their products play a critical role in the solar power industry, helping in the enhancement of solar cell efficiency and performance.

- OCI Company Ltd. Originating from South Korea, OCI Company Ltd. has earned acclaim for its substantial production capacity, approximated at 70,000 MT annually. The company’s stringent adherence to quality and innovative approach has enabled it to secure substantial market share. Their products are pivotal in the manufacturing of high-efficiency solar cells and electronic components, optimizing performance and durability.

- GCL-Poly Energy Holdings Limited GCL-Poly, based in China, has been a key contributor to the global polysilicon supply with a remarkable production capacity of over 65,000 MT per annum. The company excels in producing polysilicon that meets the high-quality standards required for efficient energy conversion in solar cells and other applications.

- Other Major Producers Apart from the aforementioned companies, there are numerous other producers like REC Silicon and Hemlock Semiconductor, contributing significantly to the global polysilicon production.

Production Capacity Analysis

Analyzing production capacity is integral for understanding the supply dynamics of the polysilicon market. Wacker Chemie AG leads the industry with a capacity exceeding 80,000 MT annually, followed closely by OCI Company Ltd. and GCL-Poly, with capacities of 70,000 MT and 65,000 MT respectively. These capacities are reflective of the companies’ commitment to meet the soaring global demand for polysilicon and their significant investments in enhancing production efficiencies and reducing operational costs.

Production Technology and Innovation

Innovation and technology are the cornerstones of polysilicon production. Top producers invest extensively in R&D to develop technologies that optimize the purity and efficiency of polysilicon.

Production Regions

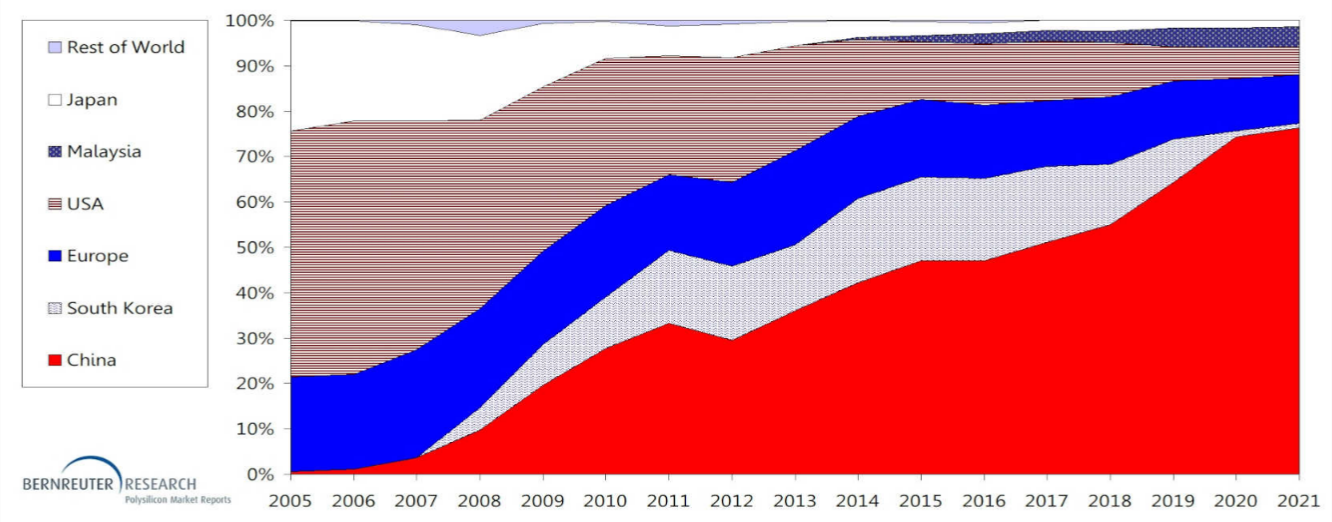

Overview of Production Regions

Different regions host a myriad of companies that specialize in producing high-quality polysilicon, used primarily in the manufacture of solar cells and semiconductors.

The geographic diversification of production regions facilitates uninterrupted supply chains and ensures the availability of polysilicon across the globe.

Asia-Pacific Polysilicon Production

Companies like GCL-Poly and OCI Company Ltd. dominate the production landscape in this region.

- China: China remains the powerhouse in polysilicon production, contributing massively to the global supply. Chinese companies, backed by substantial government support and investments, have been optimizing production processes and scaling up capacities to meet the burgeoning global demand. The concentration of several major producers in China amplifies its influence in shaping the polysilicon market dynamics and price structures.

- South Korea: South Korea, with companies like OCI Company Ltd., is also a significant contributor to the polysilicon supply. The country is renowned for its technological prowess and innovation in polysilicon production, ensuring the manufacture of high-purity and high-quality products.

Europe Polysilicon Production

German company Wacker Chemie AG is a leading player in this region, known for its advanced production technologies and high-quality polysilicon output.

North America Polysilicon Production

The region focuses on deploying state-of-the-art technologies and adhering to rigorous quality standards to produce high-purity polysilicon.

Polysilicon Prices and Market Trends

Polysilicon Price Trends

Understanding polysilicon price trends is crucial for stakeholders and market players.

This surge in prices reflects the heightened demand for high-quality polysilicon for solar PV applications and the semiconductor industry.

Factors Influencing Polysilicon Prices

Various factors drive the fluctuations in polysilicon prices. Supply and demand dynamics are primary determinants, with any imbalance leading to price adjustments.

- Cost of Production: The overall cost of producing polysilicon, including raw material costs, energy expenses, labor charges, and operational costs, significantly influences its market price.

- Government Policies and Regulations: Policies, subsidies, and tariffs imposed by governments can also impact polysilicon prices. Changes in trade policies or imposition of tariffs can lead to adjustments in pricing structures.

- Technological Advancements: Breakthroughs in production technology can lead to cost reductions and efficiency improvements, subsequently affecting polysilicon prices.

- Market Demand: The rising demand for solar energy solutions and semiconductors propels the demand for polysilicon, influencing its market price.

Future Market Predictions

The global push towards renewable energy is expected to sustain the demand for polysilicon, potentially leading to increased investments in production capacities and technological advancements.

Polysilicon Demand Analysis

Demand Overview

The demand for polysilicon is driven predominantly by its extensive applications in solar photovoltaic (PV) cells and semiconductors. It is critical to analyze this demand to align production strategies and ensure market stability and growth.

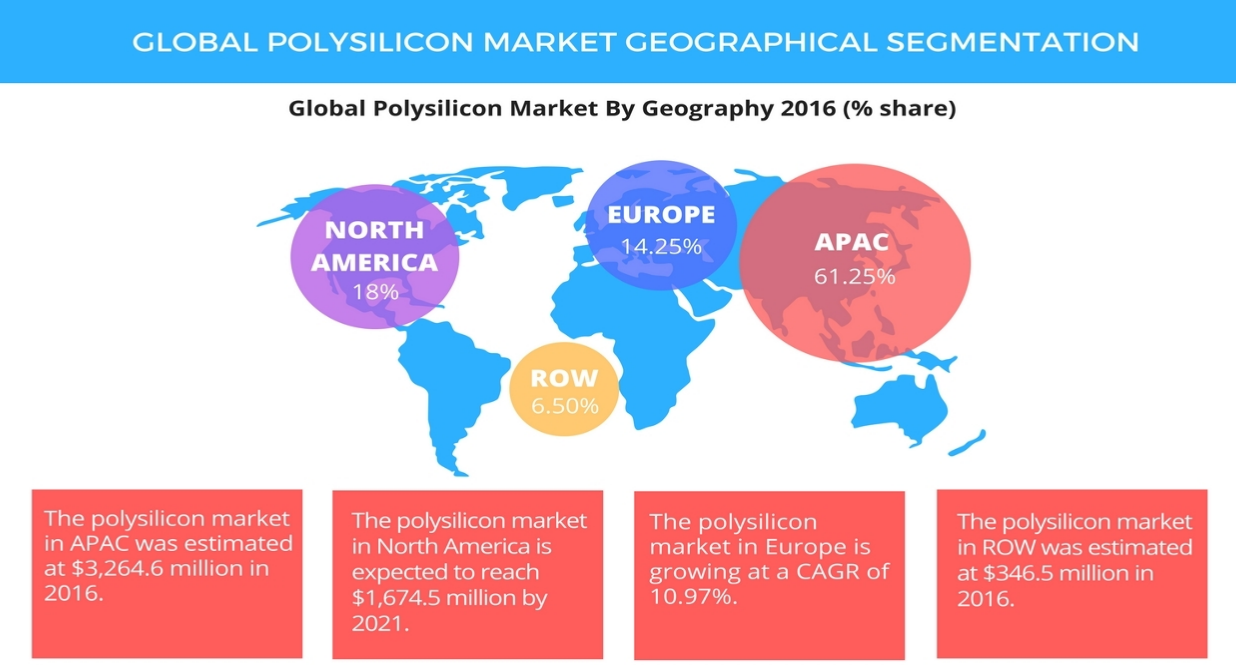

Demand by Region

The polysilicon demand landscape is diverse, with different regions exhibiting varying levels of demand based on their industrial activities, energy needs, and technological advancements.

- Asia-Pacific: The region is a significant demand center for polysilicon, fueled by extensive industrial activities, rapid adoption of solar energy solutions, and advancements in semiconductor technologies, primarily in countries like China and South Korea.

- Europe: Europe, with its robust industrial base and emphasis on renewable energy solutions, also exhibits substantial demand for polysilicon, contributing to the overall market dynamics.

- North America: The demand in this region is driven by advanced industrial activities, technological innovations, and the adoption of cleaner energy solutions, with countries like the United States leading the way.

Demand by Application

Understanding the demand by application is crucial for market participants to formulate strategic approaches and optimize resource allocation.

- Solar Industry: The solar industry is a major consumer of polysilicon.

- Semiconductor Industry: The semiconductor industry is another significant segment driving polysilicon demand.

Environmental and Regulatory Considerations

Environmental Impact of Polysilicon Production

Polysilicon production, essential for solar and semiconductor applications, does come with substantial environmental considerations. The production process can be energy-intensive and may involve chemicals that, if not handled properly, could have significant environmental repercussions.

Regulatory Framework and Policies

Compliance with established regulatory frameworks and policies is crucial in ensuring the environmentally responsible production of polysilicon. Different regions have varying regulations governing environmental protection, worker safety, and waste management in polysilicon production.

It helps in maintaining industry standards, fostering sustainability, and ensuring the long-term viability of polysilicon production.

Industry Best Practices

Adoption of industry best practices is vital in minimizing the environmental impact of polysilicon production. Implementing energy-efficient production processes, optimizing resource utilization, and deploying effective waste management strategies are critical components of responsible polysilicon production.

Challenges and Opportunities

Challenges in Polysilicon Production

The production of polysilicon encounters several challenges, chiefly stemming from high energy requirements, stringent quality standards, and environmental considerations.

Managing and treating byproducts and wastes, like silicon tetrachloride, necessitate advanced technologies and adherence to environmental standards to avoid harmful ecological impacts.

Fluctuations in polysilicon prices, driven by supply-demand dynamics, can impact profitability and market stability, necessitating effective market analysis and strategic planning for polysilicon producers.

Opportunities for New Entrants and Existing Players

The surge in solar energy adoption provides ample market opportunities for polysilicon producers to expand their operations and innovate in product offerings.

Existing players can explore opportunities in market expansion, production optimization, and product diversification.