As of 2022, China produces approximately 70% of the global polysilicon supply.

Global Polysilicon Production Landscape

The global landscape of polysilicon production has seen significant shifts over the past decades.

Major Polysilicon Producing Countries

- China: As of the last data available in 2022, China was the leading producer of polysilicon, accounting for a significant majority of global production. More on China’s polysilicon production on Wikipedia.

- Germany: Historically, Germany has been a significant player in the polysilicon market. Companies like Wacker Chemie AG have been at the forefront of European polysilicon production.

- USA: The United States, home to companies like Hemlock Semiconductor and REC Silicon, has been another major producer, although its market share has decreased in the face of rising competition from China. Learn more about the US’s role in the industry here.

- South Korea and Japan: Both countries have seen an increase in polysilicon production capabilities, driven by their respective semiconductor and solar industries.

Historical Trends in Polysilicon Production

The 1980s and 1990s saw a surge in polysilicon demand due to the semiconductor boom. As the 21st century approached, the rising adoption of solar panels drove further demand for high-quality polysilicon.

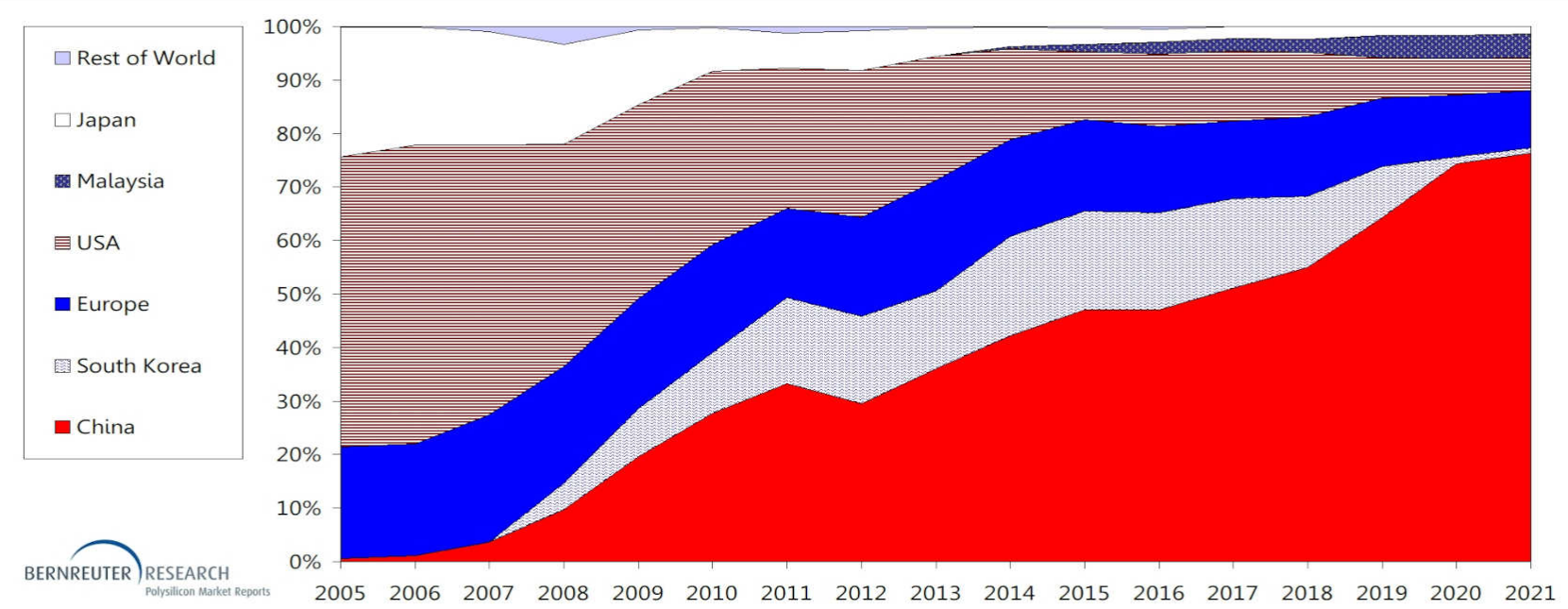

The 2000s marked the entry of China into the global polysilicon market. Initially, they imported significant volumes but swiftly transformed into the world’s leading producer by the 2010s.

In contrast, Europe and the USA, which were once dominant players, began facing stiff competition from China, leading to a shift in global production dynamics.

The sustainability and environmental impact of polysilicon production have also become topics of concern in recent years. This has driven research into more eco-friendly methods of production and recycling.

China’s Role in the Polysilicon Industry

China’s meteoric rise in the realm of polysilicon production has not only shifted the dynamics of the global market but has also established the nation as a crucial player in both the solar and semiconductor industries.

Historical Overview of China’s Polysilicon Production

China’s journey in the polysilicon sector began in earnest during the early 2000s. At this time, China was primarily an importer of polysilicon to meet its burgeoning domestic demand. But as the years progressed, especially post-2005, there was a noticeable push by the Chinese government and private enterprises to establish a robust domestic polysilicon production capacity.

By the end of the first decade of the 21st century, China’s domestic production had skyrocketed. This aggressive expansion led China to significantly reduce its dependence on imported polysilicon and eventually become a net exporter. As of 2022, China dominated the global polysilicon market, producing a lion’s share of the world’s supply. A deeper understanding of China’s polysilicon journey is available on Wikipedia.

Factors Driving China’s Polysilicon Production Growth

Several key factors have underpinned China’s success in the polysilicon industry:

- Government Support: The Chinese government recognized early on the strategic importance of the polysilicon sector. This led to policies, incentives, and financial support aimed at fostering the growth of domestic polysilicon industries.

- Economies of Scale: China’s vast industrial base, coupled with significant investments in the sector, allowed for large-scale production, which in turn led to cost advantages.

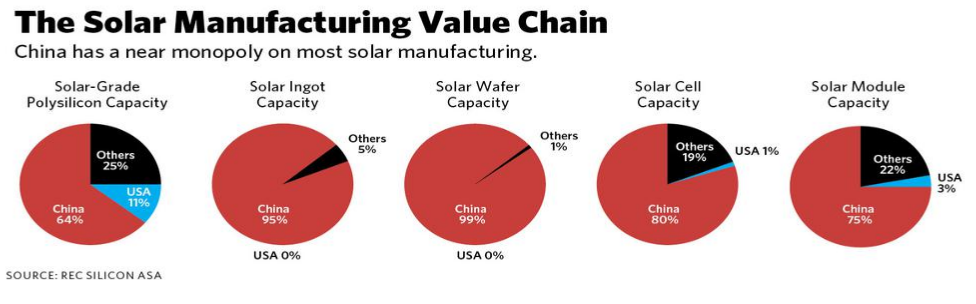

- Rapid Expansion of the Solar Industry: As the world’s largest producer of solar panels, the domestic demand for high-quality polysilicon in China is enormous. This domestic demand, coupled with global needs, further bolstered China’s push into polysilicon production.

- Technological Advancements: Chinese firms have invested heavily in research and development, leading to advancements in production techniques, which have improved efficiency and reduced costs.

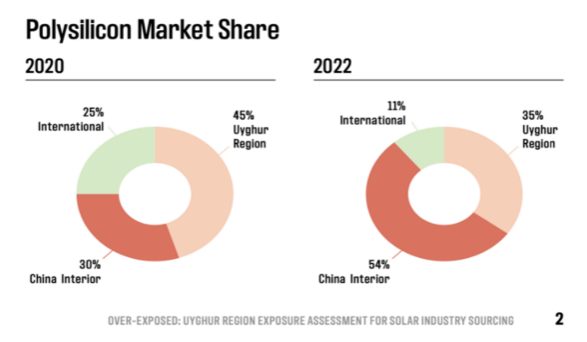

- Infrastructure and Resource Availability: Provinces with abundant coal and energy resources, such as Xinjiang and Inner Mongolia, became hubs for polysilicon production due to the energy-intensive nature of the production process.

In conclusion, China’s strategic approach, combined with its vast resources and immense market demand, has solidified its leadership position in the global polysilicon landscape. You can further explore the intricacies of China’s growth in this sector here.

Percentage Breakdown of Polysilicon Production

The distribution of polysilicon production has evolved over the years, with certain nations cementing their dominance in the sector. A clear understanding of the percentage breakdown offers insights into the changing dynamics of the global market and the pivotal role of key players, especially China.

Current Percentage of Polysilicon Produced in China

As of the latest available data from 2022, China has firmly established itself as the juggernaut in the polysilicon industry. The country is responsible for producing an estimated 70% of the global polysilicon supply. This significant market share is a testament to China’s aggressive expansion in the sector, benefiting from both economies of scale and technological advancements. The vast domestic demand for solar panels and semiconductors has further propelled China to ramp up its production capacities.

Comparison with Other Leading Producers

- Germany: Historically a heavyweight in the polysilicon domain, Germany now accounts for approximately 10% of the global production. Firms like Wacker Chemie AG have been central to Germany’s contributions in this sector. Learn more about Germany’s polysilicon industry here.

- USA: Contributing around 8% to the global tally, the United States has seen a decline in its market share over the years. However, companies like Hemlock Semiconductor still play a significant role in the global landscape. A deep dive into the US’s contribution is available here.

- South Korea and Japan: Combined, these Asian powerhouses contribute roughly 9% to the global polysilicon production. Their production capabilities have grown in response to their robust semiconductor and solar industries.

- Rest of the World: The remaining percentage of global polysilicon production is shared among various countries, each with its own set of industries and demands.

Impact of China’s Polysilicon Production on Global Market

China’s unparalleled growth and dominance in the polysilicon sector have far-reaching ramifications for the global market. From price dynamics to environmental concerns, China’s role in this industry affects every facet of the polysilicon trade.

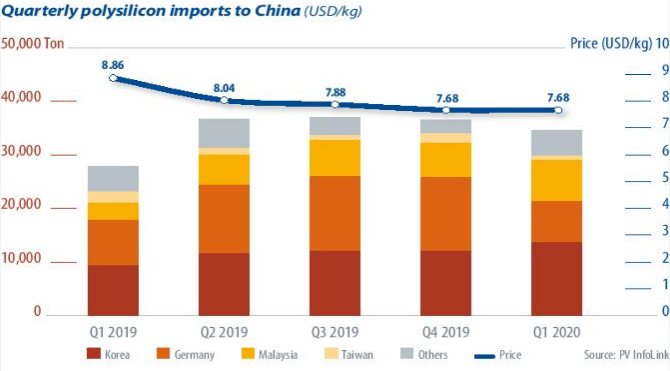

Price Dynamics and Market Control

China’s meteoric rise in polysilicon production has had a profound influence on global price dynamics. Due to its vast production capabilities, China exerts significant control over the market prices of polysilicon. With economies of scale in play, Chinese manufacturers can produce polysilicon at competitive rates, which often leads to downward pressure on global prices.

This pricing advantage has given China a competitive edge, often making it challenging for manufacturers in other countries to compete on a cost basis. The ripple effect has led to several global manufacturers either scaling down their operations or focusing on niche markets where they can command a premium. This price control has further strengthened China’s position, allowing it to dictate terms in international trade negotiations and contracts.

For industries dependent on polysilicon, such as the solar panel industry, this means more affordable raw materials, which can potentially lead to reduced costs for the end consumers. However, there are concerns about over-reliance on a single dominant supplier, which can have implications for supply chain security. Explore more about global polysilicon pricing dynamics on Wikipedia.

Environmental Considerations in China’s Polysilicon Production

Polysilicon production is an energy-intensive process. China’s vast production capabilities have raised environmental concerns, especially considering the country’s reliance on coal-based power generation in many regions. The carbon footprint of polysilicon produced using coal power is significantly higher than that of polysilicon produced using cleaner energy sources.

China has been making strides in addressing these concerns. Many new polysilicon plants in China are adopting cutting-edge technologies to minimize their environmental impact.

However, environmental activists and global watchdogs continue to monitor the environmental implications of China’s polysilicon production, advocating for more sustainable practices. A deeper dive into the environmental aspects of polysilicon production is available here.

In summary, while China’s dominance in the polysilicon sector has reshaped the global market dynamics, it brings with it a set of challenges and responsibilities. Balancing economic growth with environmental stewardship will be crucial for the sustainable future of this industry.